The vehicle’s registration number is shown on the registration certificate under the heading ‘Plate’ and on the front and back of your vehicle.

Get a quote in minutes!

Provide us with two specific pieces of information to help us identify you, and we will immediately transfer your CTP details to TfNSW.

Compulsory Third Party (CTP) Insurance, known as a CTP Green Slip, is required to register a vehicle in New South Wales. It’s mandatory in NSW for all vehicles other than caravans and trailers, and must be purchased before you can register your vehicle.

CTP Green Slip Insurance covers the liability of anyone driving your vehicle in the event that they are responsible for injuries caused in a motor accident. It can also help you cover medical expenses and a percentage of your pre-injury income if you are unable to work as a result of the accident for up to 52 weeks, regardless of who caused the accident.

For more information, visit the NSW State Insurance Regulatory Authority (SIRA) website.

Shannons provides cover for motoring enthusiasts of all kinds on the road and at home.

Compulsory Third Party (CTP) Personal Injury Insurance, also known in NSW as a CTP Green Slip, is mandatory and must be purchased before you can register your vehicle.

CTP Insurance covers your liability and the liability of anyone else who drives your vehicle, for injuries caused to others in a motor accident. Anyone injured in a road accident can claim for medical expenses and a percentage of your pre-injury weekly income if you need time off work for up to twelve months, regardless of fault (unless you are charged with a serious driving offence).

Visit the SIRA website for more information as conditions do apply.

Have any combination of the following details handy to get a quick quote:

If you don’t have the required information, you will still be able to obtain a CTP Green Slip quote but you will not be able to purchase a policy. You can request this information from TfNSW by calling 13 22 13.

If you’ve paid for your CTP Green Slip online or by phone, an eGreen Slip will be sent to TfNSW within an hour of payment. If you’ve made your payment at a Post Office, it will take up to 2 business days for the eGreen Slip to reach TfNSW.

If you’re moving to NSW, you’ll need to purchase a CTP Green Slip and obtain a Safety Check prior to registering your vehicle with Service NSW. Until you register your car in NSW, it will be considered unregistered, even if your vehicle still has current registration from where you were previously living. Visit Service NSW for further details and requirements.

If you’re moving away from NSW, you’ll need to refer to your new state or territory’s requirements and timeframes for transferring your vehicle registration.

We only use information from TfNSW that is necessary to provide you with an accurate CTP Green Slip quote. This information has always been required to be provided when purchasing a CTP policy.

You can find out more information on how we handle your privacy here.

Quotes from other websites, including the SIRA Green Slip Check, are estimates based on information you provide. The Green Slip quote from us uses registration information held by TfNSW. Prices may not match if the information you provide is different.

At Shannons, we take your feedback seriously. You can submit a complaint or feedback by visiting the Dispute Resolution page.

If you are eligible for TfNSW 'auto registration renewal' service offered to some pensioners, you need to pay your CTP Green Slip before the registration renewal date. After you pay your CTP, we recommend you check with TfNSW directly to confirm if your registration has been renewed.

You’ll find information about what you need to do to lodge a CTP Green Slip claim at Before making a NSW CTP claim.

CTP Insurance is Underwritten by AAI Limited ABN 48 005 297 807 trading as GIO. Shannons Pty Ltd ABN 91 099 692 636 acts as an agent and authorised representative of GIO.

Some older vehicles do not have a VIN or it is shorter than the usual number so this can impact the transmission of the eGreen Slip to TfNSW. In these cases, you may need to take your paid Green Slip into TfNSW to renew your registration.

Shannons CTP is issued by GIO, one of the 6 licensed insurers approved by SIRA to provide CTP cover in NSW. Shannons acts as an authorised agent of GIO.

If you have a light vehicle (vehicles with GVM less than 4.5 tonnes), you have the option to choose between a 6 month or 12 month term. As long as you pay for both the CTP Green Slip and registration within 21 days of the due date, you can choose a 6 month term for the renewal of your CTP.

If it’s been more than 21 days since your registration was due, you can only choose the 12 month period, unless there are ‘extenuating circumstances’ for us to accept the late payment.

CTP Green Slip is linked to the vehicle, not the owner, so if you sell your vehicle, the CTP Green Slip will be transferred to the new owner.

Please ensure you have completed the transfer a vehicle registration form with Service NSW.

Safety checks can only be performed at authorised inspection stations and the results are sent to TfNSW electronically.

Safety check (previously called a pink slip) when renewing registration:

To renew registration in NSW, most light vehicles more than 5 years old must undergo a safety check to ensure they meet minimum safety requirements.

Vehicles not currently registered in NSW:

Vehicles not currently registered in NSW must have an Authorised Unregistered Vehicle Inspection Scheme (AUVIS) inspection (formally called a blue slip) before they can be registered.

Visit the TfNSW to find out more.

There are only some circumstances under which you can cancel your CTP Green Slip. Please call us on 13 46 46 and we will help you with any cancellation.

To enable us to process a mid term cancellation, you will need to supply a confirmation of cancellation letter from Service NSW.

You can receive your CTP Green Slip documents via email and we may send you reminders via sms. You can consent to receiving your CTP Green Slip documents electronically when setting up your CTP Green Slip online or when you contact us to set up or renew. All you need to provide is a regularly used email address and mobile phone number. If you consent to receiving your CTP Green Slip documents electronically you will not receive policy documents and communications via post.

Where can I find my Registration/Plate Number?

The vehicle’s registration number is shown on the registration certificate under the heading ‘Plate’ and on the front and back of your vehicle.

Where can I find my Vehicle Identification Number?

The vehicle's identification number (VIN) is shown on the registration certificate under the heading 'VIN/Chassis Number'.

Where can I find my Chassis Number?

The vehicle's chassis number is shown on the registration certificate under the heading 'VIN/Chassis Number'.

Where can I find my Engine Number?

The vehicle’s engine number is shown on the registration certificate under the heading ‘Engine Number’.

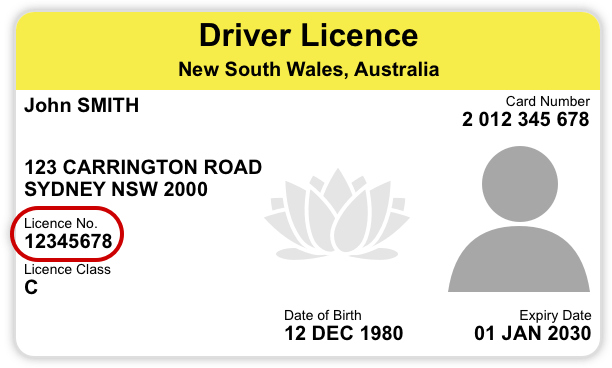

Where can I find my Licence Number?

Your NSW driver licence number can be found under ‘Licence No’.

For example:

Where can I find my Billing Number?

The billing number is shown on the registration certificate under the heading ‘Billing Number’.

For example:

Where can I find my Photo Card Number?

Your NSW photo card number is located below your address on your NSW photo card.

For example:

Where can I find my TfNSW Number?

Your customer number can be found on the registration certificate under the heading 'Customer Number'.